Qinwen Wang

The web3 investor and collector believes in the importance of bridging the physical and digital worlds.

Histories of the NFT market often begin with CryptoPunks, the code for which is widely credited with inspiring the ERC-721 protocol that most NFTs use now. But blockchain assets existed years before that. An Australian investor and collector who goes by the moniker White Rabbit is one of the digital archaeologists who research those early experiments and collect key examples. He published a timeline on Medium last year summarizing his findings. In the interview below, White Rabbit discusses some of the highlights of his collection, how they fit into the history of tokenized assets, and the tools that have been developed to make these digital artifacts accessible now.

Adam McBride was the one who coined the term NFT archaeologist. It resonates for me because it’s a bit like finding a relic and attaching it to meaning and doing it in an almost scientific way, digging through different strata to preserve that history. I wanted to put out a timeline because I was frustrated with the incorrect narrative that it all started with CryptoPunks. I collect those. They’re historical and I think they have great value. But after encountering them I searched back further and I discovered the Rare Pepes, and then other projects that had been on Bitcoin. I wanted to create an accurate narrative for posterity, because I think this stuff is going to change the world in radical ways. I don’t claim to have any skills when it comes to assessing art. I can appreciate it but I have no expertise. I look for what I feel is significant in terms of its social and historic nature.

The oldest asset in my collection is a very primitive one from 2012 on Namecoin, which is the only blockchain other than Bitcoin that Satoshi Nakamoto worked on. It’s called a Punycode, which could be used to mint an image. You’d have to take the Punycode from the chain and then plug it into the Punycode website which then reveals what it is. It could be an emoji. It could be a whole range of different things. Mine’s a Chinese character. That was a very recent discovery by one of the archaeologists who researches these things. It’s a bit like the Rosetta Stone: these are the early hieroglyphics and you needed something to interpret what they even meant.

I’ve got a Crypto Egg. Back in the day, when signed up for Twitter they’d give you an egg for your PFP. The intent was that you’d replace it with your own image. But people really liked their eggs and left them up. Twitter didn’t like that, so eventually they replaced the egg with the empty silhouette they’ve got now. There was a program on Namecoin that allowed people to create an identity, and the software pulled information from their Twitter profile and put it on-chain. Some users still had the egg PFP, so it basically tokenized the egg to the blockchain. It was a very early tokenization of a PFP. Only about 270 accounts tokenized the egg, and it was never intended to be tradeable or valuable. They were all separate, but now there’s this collection of tokenized Twitter eggs from 2014. With Namecoin you need to renew a token every six to nine months or you effectively relinquish ownership. You’re almost renting it, in a sense. A lot of those eggs had expired and other people who could see where all this was going reckoned they would be significant. So they renewed those early assets and took ownership of them. And since then there has been a lot of trading and selling of these early unintentional NFTs.

I’d have to say my most prized possessions are FD cards, which were released in March 2015. They’re the first tokenized gaming assets ever to be put on-chain. A lot of them have been lost because no one knew what they were. They were released as part of a project where people would share computing power and contribute to a supercomputer that was used to research cures for cancer and other diseases. If you took part in the initiative, which was called FoldingCoin, you’d get an FD Card as a reward. That’s how they were distributed originally. And then they could be used in the Spells of Genesis game, which was the first blockchain-based game ever produced. The Satoshi card was in the same series. That was the first card that was interoperable between two different games by two different devs, which in essence is the birth of a metaverse asset. So it’s one of my most treasured pieces.

They commissioned artists to create the artwork for these cards. It wasn’t different from the Rare Pepes that came just after, where contributions were crowdsourced and compiled. The innovation started with Spells of Genesis but it was popularized by the Rare Pepe project.

Rare Pepe was the project that birthed the global crypto art movement back in 2016. It was a crowdsourced project, with tokens minted on Bitcoin using a protocol called Counterparty. It had nothing to do with the right-wing rubbish that was going on with Pepes around that time. It was very much a love of the internet meme. There wasn’t an intent to make money. It was a community of people having fun and minting stuff.

There are still series of Rare Pepe art being released on Bitcoin now, and you might see them called Fake Rares. There’s this angst the community, with people saying if it’s not from this approved period of Rare Pepes it doesn’t count. Some of the artists who were on there are now minting onto Dogecoin using a protocol similar to Counterparty. They’re minting and selling Doge memes. It’s not hard to do it and it’s very cheap. I’m not seeing 10K PFP projects tokenized on Bitcoin like there are coming out every second on Ethereum. But there are some pretty fun projects.

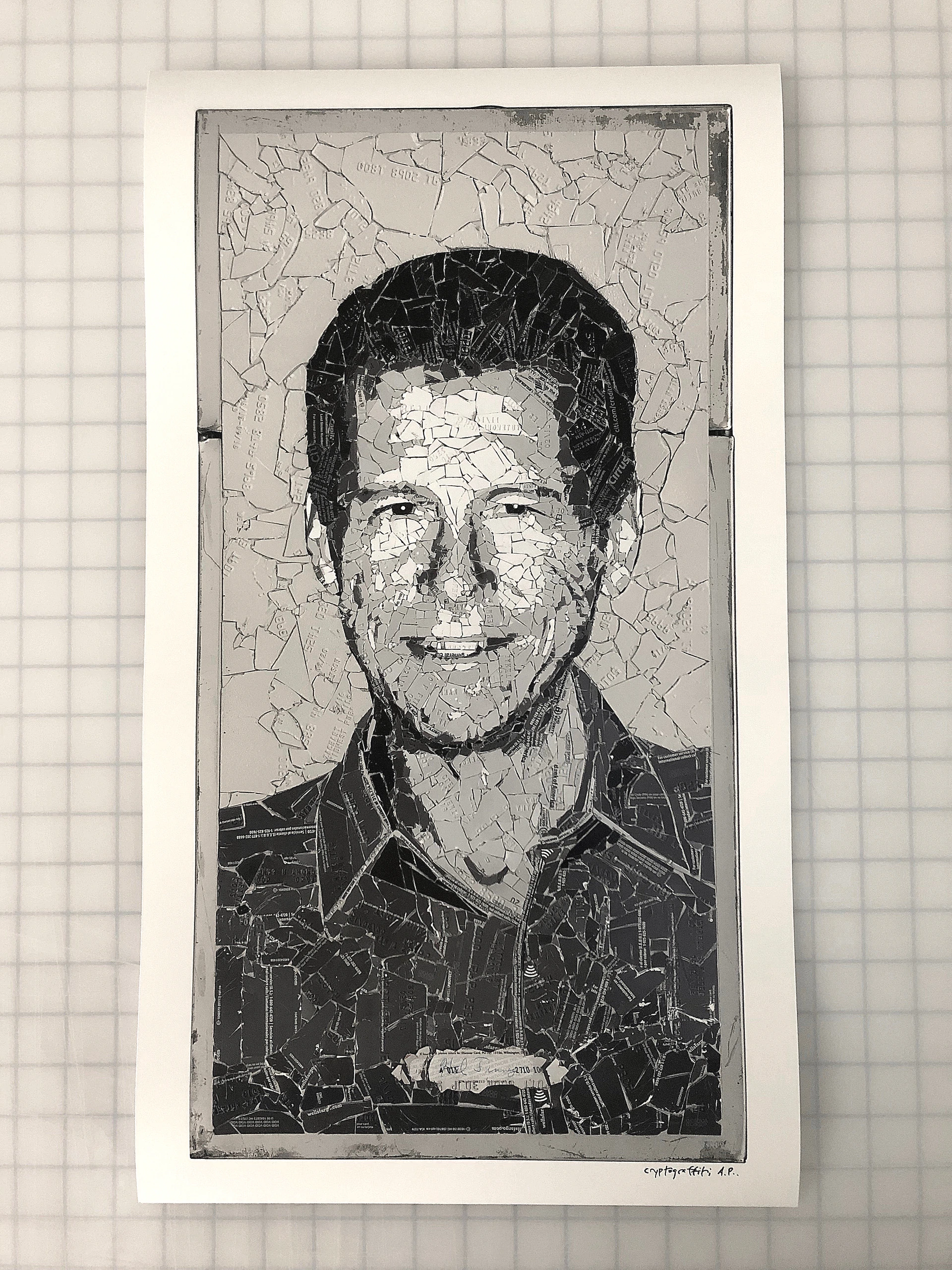

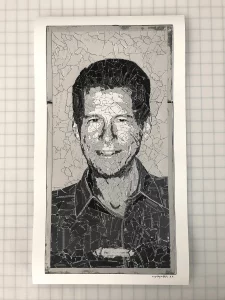

I also collect early Bitcoin art and crypto art—propaganda pieces that artists were making to convince people of the power of digital currencies. In 2014 these artists were making physical pieces. In 2016 they started tokenizing their work. Some of them have gone to Ethereum and other chains. cryptograffiti is one of the prime ones. I have a limited release print from him with a portrait of Hal Finney, who received the first transaction of Bitcoin from Satoshi Nakamoto. And you actually got a small shard of Finney’s credit card with the print. cryptograffiti also contributed to Curio Cards, which was the first art project on Ethereum. He did three or so of those, and all of them were Bitcoin themed. He wanted to use that first tokenized art on Ethereum to promote Bitcoin.

I don’t have any concerns with any of my Bitcoin assets in terms of how safe they are. I’m a bit more nervous about my Ethereum ones with everything that’s been going on, with all these hacks and email phishing scams. It seems like anyone with an Ape can’t hold onto it.

Emblem Vault is a fantastic initiative that was developed by Emblem Finance. They were originally building a multichain or chain-agnostic marketplace, but then they realized it was a way for those Bitcoin and Namecoin assets to be traded effectively on the Ethereum blockchain. It doesn’t actually take them off the chains they’re on or put them on Ethereum. It puts the information needed to access those assets in a locked vault that only the owner can open.

Some people will say a token is not a real NFT because it’s not 1/1, or if it’s on Namecoin it has an expiration date and has to be re-registered, so its status as a token isn’t permanent. To that I say, the first lightbulb created wasn’t your LED. The first was a pretty dodgy and fragile invention that then evolved and developed. That’s my thesis of value for these early relics. You have to look at it as a continuum. The question of what is or isn’t an NFT isn’t black-and-white. The market has taken that terminology to mean a whole lot more than what that original very technical definition ever meant. NFT is now a generic term for tokenized assets.

As a collector I’ve come to love these early relics. There are very few left to be discovered at this point. I will continue to try to leave an accurate narrative of where all this came from for posterity.

My advice to anyone is: look around and be aware of the of the time you’re in. We are in an emergence period of a new technology that’s going to be the bedrock for our digital future. A lot of people will kick themselves for chasing the next billion-dollar 10K PFP project when all of that is a lot of fluff that will go to zero. But the role these early tokens have played are locked in stone. They have a place that will always be significant.

—As told to Brian Droitcour