Linda Dounia

The Senegal-based artist talks about working with AI tools and sharing knowledge with her community.

Brian L. Frye and Primavera de Filippi are two lawyers who have made art to explore the ramifications of intellectual property law. With Aaron Wright, de Filippi coauthored Blockchain and the Law (2018), a speculative book about legal problems raised by blockchain technologies and possible solutions to them. But she had previously approached similar questions through Plantoid (2015), an artwork in the form of a mechanical plant that reproduces itself via transactions on the blockchain. Frye published a paper in 2019 likening the purchase of conceptual art to the acquisition of shares in an abstract business proposition, which therefore makes it a violation of the 1933 Securities Act. This primed him to see the NFT market as a shift in the perception of intellectual property that applied the model of the art market to all kinds of creative work. He subsequently released several of his own NFT series based on various types of conceptual art and intellectual property, including a collection of drawings from abandoned patents issued between 1842 and 1925. Frye and de Filippi met to discuss their research and advocacy related to the blockchain and IP rights. Both have been active in the Creative Commons community, seeking alternatives to copyright to encourage the free dissemination of creative work. But they clashed over the potential of NFTs to displace copyright. Frye believes the market conditions they have created are transformative, but de Filippi sees NFTs as an engine of unproductive speculation that can’t satisfy the needs of artists without encoding rights. Their debate is full of fruitful insights into the business of art, and how value is created from the relationships between artworks and audiences.

PRIMAVERA DE FILIPPI The idea of Plantoid was to illustrate the legal challenges raised by blockchain technology. I instantiated a DAO in the form of this mechanical plant whose objective is to reproduce itself. The members of the DAO are the people who hold the seeds of the Plantoid, which takes the form of an NFT. The Plantoid uses the blockchain as a mechanism to collect funds and then spend those funds to commission artists to make new plantoids.

If you fund the Plantoid, you can collect an NFT, which represents a “seed” of the Plantoid. Humans act like pollinators, transferring seeds around, in order to help the Plantoid reproduce. The “pollination” process is such that every time the NFT gets transferred on the secondary market, 10 percent of the resale price is sent back to the Plantoid. When the Plantoid has acquired enough funds to reproduce itself, it opens a call for proposals, inviting people to submit propositions about how they envision the next Plantoid. Whoever holds a seed of the Plantoid can vote on the proposal they like best, to determine how the Plantoid will evolve. The voting triggers the transfer of funds to the artist who submitted the winning proposal.

This raises important legal questions. What does it mean when you send cryptocurrency to the Plantoid’s smart contract? Who holds that cryptocurrency if the recipient doesn’t have a legal personality? What happens when the Plantoid commissions an artist to create a new replica of itself? Can there be a legal contract between the Plantoid and the artist? Or are the parties to such a contract the artist and the holders of the NFTs? And if the artist ran away with the money without fulfilling the contractual obligation, who can sue on the Plantoid’s behalf?

BRIAN L. FRYE Do you see the project as a way of illustrating how the law should resolve some of those questions or as a way of illustrating how and why the law doesn’t necessarily have good answers to some of those questions?

DE FILIPPI The art piece only illustrates the existing legal challenges. It doesn’t give any answers about how the law should tackle them.

FRYE You coauthored Blockchain and the Law, which anticipates a lot of these problems. To what extent do you see some of those questions getting answered de facto or de jure? What do you see as the big open questions right now in the law of NFTs?

DE FILIPPI The questions around the qualifications of ICOs and token sales have been largely resolved. But overall the law has not advanced as much as it could have. I find it quite surprising that although the book was published in 2018, it’s still quite current. The big questions that remain open concern the legal qualification of DAOs, what kind of contractual or non-contractual relationship can be created with these entities, and what the rights of DAO workers are. Back in 2018, these questions were mostly speculative, whereas now it’s very common for people to work for a DAO. But it’s difficult to take care of all the required legal formalities, i.e. declare where the money comes from, who you are working for, who is paying you, how you pay taxes, and so on.

With regards to NFTs, there’s a different set of legal questions, which aren’t related to legal personality and legal capacity, but rather to copyright and IP. It is unclear which rights, if any, are being licensed when someone acquires an NFT. When the copyright is explicitly being licensed, it’s usually done via a centralized platform that defines the rights in their own terms of service. These rights are not embedded in the token and therefore can be changed at any time. So there is a lot of legal uncertainty as well, but for very different reasons, and the NFT issue is easier to solve. It’s just a matter of crafting proper techno-legal solutions that enable the licensing of rights to follow the transfer of the tokens.

The questions concerning the legal challenges of DAOs are more challenging because they ask how we deal with something that has technical and economic agency, but does not have legal personality or legal capacity.

FRYE How do you think a DAO is different from a partnership or an unincorporated association, in legal terms?

DE FILIPPI If you don’t incorporate a DAO, then the law will most likely qualify the DAO as a general partnership, meaning that everyone is potentially jointly liable to any activity that the DAO is engaging in, even if they have not participated at all. This is a problem because it is difficult to define who precisely are the members of the DAO, when you can just airdrop tokens to people and then claim that they’re jointly liable for something they’re not even aware of. DAOs that have not been incorporated are limited in their usability, because a lot of people will not want to engage in a DAO if they know they’ll have these liabilities. So we need to find a solution, but the law—as it stands—doesn’t have the tools to fully understand how a DAO works. Plus, every DAO is different and can be interpreted in a different light.

Of course, you can always create a legal entity whose bylaws stipulate that it is administered through a blockchain infrastructure. But if we want to ensure that these technologies can be used more broadly, then it becomes necessary to identify a solution. Some countries are trying to experiment with blockchain-based limited liability corporations, but so far their application is very restrained, and most DAOs will not fit within those legislations. I cofounded an organization called COALA, which is working on developing a legal framework for recognizing DAOs as legal entities with limited liability so long as they meet specific requirements.: the DAO Model Law. But it is still too early for any of those provisions to be understood or adopted by an actual legislative body.

FRYE From a policy perspective, there’s a big picture question as to whether the law should evolve to accommodate actual business and social practices that people are engaged in, or whether the law should see its role as creating ground rules that people engaging in those business practices must conform to. One analogy would be a situation like the Uniform Commercial Code, where the law tries to describe what’s happening and help create uniform expectations. Or should we look at this in more of a traditional regulatory format where the law tells people what they’re allowed or not allowed to do?

DE FILIPPI The problem is that we are not in a traditional system where you can easily tell people what to do. DAOs do not exist in a particular jurisdiction, and their members often stay anonymous or pseudonymous, so it’s hard to enforce the regulation. The way in which we are approaching it with the DAO model law is through the concept of functional equivalence and regulatory equivalence.

Functional equivalence means that instead of creating specific regulations for DAOs, the law could introduce specific features and criteria that DAOs need to meet in order to be functionally equivalent to an existing legal entity. This is what the United Nations Commission on International Trade Law has done with electronic contracts, e.g. providing conditions for an electronic document to be regarded as equivalent to a paper document.

Regulatory equivalence requires that the law recognize blockchain technology as a potential tool for regulatory compliance. DAOs can achieve specific regulatory objectives in ways that might not require the same burden of formalities, oversight, auditing, and so forth, because of the technological guarantees they embody. However, that is challenging because it requires regulators to understand how blockchain-based systems can be implemented to ensure that a particular technological design incorporates sufficient guarantees.

The benefits are significant, though. By recognizing these equivalences, regulators are creating a strong incentive for people who want to deploy blockchain-based systems to do so in a manner that is compliant with the law.

FRYE In light of that, I want to refocus our conversation on NFTs, and the intersection between the NFT market and intellectual property law. You suggested earlier that we’ve got some relatively easy answers when it comes to licensing and what it ought to look like. But I can’t help but wonder if there is maybe a similar phenomenon going on. A lot of people engaging in the NFT space seem uninterested in a traditional intellectual property format, and maybe don’t see it as something that’s really relevant to what they’re trying to accomplish. Should we think about intellectual property in the same way that we think about institutional governance or organizations law?

DE FILIPPI I don’t think that’s the same type of problem. People are mostly purchasing NFTs because they want to sell them at a higher price. They don’t really care about making use of the content associated with the NFT. So I don’t think it’s creating the same type of disruption that DAOs are creating with regard to corporate law because it’s not really disrupting copyright law—people are just ignoring it. It is of course possible to associate a copyright license to a token, as people probably want to at least have some kind of usage right associated with the ownership of the NFT.

FRYE Here I disagree with you. This is an area in which a lot of the assumptions associated with traditional copyright law don’t make sense anymore. And as people like Amy Adler have pointed out in the past, the art market has never really cared that much about copyright. It’s just a tool. It’s a way of encouraging people to invest in producing works of authorship. But if people are willing to kind of speculate in the future value of works and compensate artists or authors on the basis of their belief that something’s going to be popular in the future the same way they have for hundreds of years in the traditional art market, do we really need copyright anymore?

DE FILIPPI That’s a very narrow vision of copyright. Copyright is not only about rewarding artists, it’s also about providing control over how your work can be used, displayed, or exploited commercially and non-commercially. I think it’s fascinating that artists can now be rewarded for their artistic creations without having to license their copyright, and that they can put everything on Creative Commons because they don’t need licensing in order to monetize their works. But I think you’re making a big leap, and I say that while having just recently published a piece in FlashArt arguing that NFTs are making copyright obsolete.

FRYE But why should anyone care what artists think about how people use the work? People will use it anyway. The only real question is about the distribution of the returns.

DE FILIPPI I am a very strong proponent of Creative Commons and I believe in the value of maximizing the dissemination of creative works. But I have engaged with a lot of artists and know that some do care about how people use their works. Some have an issue with the work being modified, others do not want people to use their works for commercial purposes. That’s why I’m very keen on Creative Commons licenses, because they eliminate by default the restrictions on reproduction and distribution, but they don’t necessarily eliminate the restrictions on commercial exploitation and the making of derivative works.

FRYE It seems to me like the NFT is forcing us to reckon with a world in which the economic justification for copyright no longer makes sense as a policy tool. And we have to ask what, if anything, should ownership or control over the use of works of authorship look like going forward. That seems like a tough conversation, but it also seems like a conversation not so divorced from what you were talking about when it comes to DAOs and organizations. In other words, should the law accommodate what people are doing, or should people be forced to conform to what the law says?

DE FILIPPI Copyright law was not created because of the challenges of the digital world. Copyright was created long before the digital world came about. So I’m not sure that the existence of unique digital copies invalidates the whole justification for copyright law.

NFTs cannot force artists to withdraw their copyright. If they benefit from it, they will want to keep it. It’s on us to show them that they will benefit more by not enforcing some of their rights. That was the whole point of Creative Commons. Right now, I’m working on an initiative called Remix NFTs that is designed to create economic incentives for NFT artists to share their works.

In some ways, Plantoid is also part of this. The underlying idea was to completely flip copyright on its head, maximizing the incentive for the artist to disseminate the work. The more visibility there is, the more funds the work will collect. But most importantly, it is about eliminating the figure of the author as the key actor. You could send money to the artwork itself.

That’s disruptive, but not because of the NFT. It’s disruptive because of the DAO. It changes the balance of power between the artist and the work. The NFT is a revolutionary technology because it enables digital artists to sell unique copies. I’m not removing the importance of this innovation. I’m just saying it’s not as disruptive as the creation of an autonomous smart contract that can collect funds on its own and redistribute these funds to specific actors.

FRYE I’m not entirely sure I agree with you. I see the introduction of copyright as an early form of competition policy, essentially taking a kind of investment in the production of works of authorship, which hadn’t been economically meaningful but became economically meaningful with the introduction of the printing press as a way of essentially doling out rights in the hope of providing incentives for future production. But it seems to me, the big change with NFTs is not in creating unique digital copies, but rather accommodating many other forms of artistic or authorial production on something that looks more like an art market. And frankly, I really see the NFT as effectively enabling authors to securitize their future celebrity.

DE FILIPPI The whole art world is based on exactly the same principle.

FRYE The real interesting aspect of the NFT market to me is that it’s making something clear that the art market always should have known but was never willing to acknowledge. Walter Benjamin introduced the idea that art is about the aura of authenticity. It seems to me that what the NFT market really underlines is that the art market has always been about the aura of ownership. It’s about ownership of a place in the artist’s catalogue raisonné. That’s really radical, because what it suggests is that the NFT market is providing authors and artists with access to financial markets and capitalization in a way that hasn’t previously been available.

In the corporate world, the investment risk is primarily on the author, who has to anticipate whether or not the work is going to be popular in the future. In the art market, you’re recentering some of that risk on speculators. With NFTs you’re eliminating the middleman, to some extent, and you’re also reducing the amount of risk being borne by the authors.

DE FILIPPI But these are two different worlds. There’s the copyright world—music, films, whatever—where artists oftentimes rely on intermediaries to produce and disseminate their work. What they’re selling is the experience—the fact that you are listening to their music, going to their concert, and so on—as opposed to buying a unique piece of art. When I buy an NFT, whether it’s a video, a sound file, or a jpeg, I’m not buying the experience of engaging with the art piece. I’m buying the piece itself, the authentic and unique digital copy. So it’s a very different business.

FRYE The distinction is totally artificial though. You can have the same kind of transaction in any kind of work. It doesn’t matter. And the only reason we transacted in copies was because that was commercially convenient at the time. Just like in the art market, what you’re buying is effectively a speculative interest in the future commercial goodwill associated with an artist. And what I think is really interesting about the NFT market is it suggests that could be true for anything.

DE FILIPPI No. Copyright licensing is required for exploiting a particular intellectual creation, as opposed to speculating on a physical copy of a particular intellectual creation. Those are very different activities.

FRYE That’s totally wrong. Copyright was invented to enable people to invest in the future value of a work of authorship. The NFT market is showing us that there are tools other than copyright.

DE FILIPPI But copyright licensing is used for a very different thing. Sorry. I find this very funny because it’s the first time I’ve heard myself arguing for copyright law.

FRYE As it happens, I’m very engaged with Creative Commons myself. And in fact, I commissioned Kat Walsh to create a Creative Commons tool for me that artists and authors can use to encourage plagiarism of their works. It hasn’t seen a whole lot of play yet, but I’m hoping people will adopt it in the future.

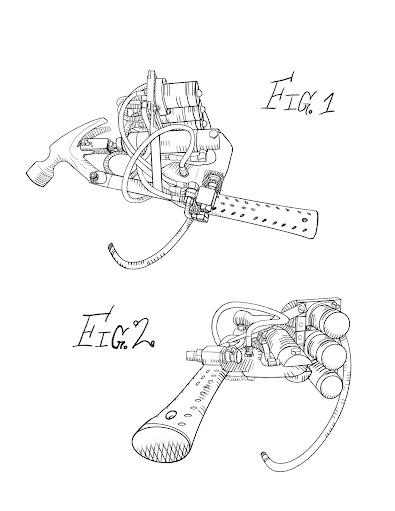

The reason I got interested in the NFT market in the first place was that I created a work of conceptual art in the form of a legal scholarship called SEC No-Action Letter Request. It entailed sending the no-action letter request to the US Securities and Exchange Commission and explaining why the work of conceptual art I was selling in an edition of fifty for 10,000 USD each was in fact an unregistered security that they should be regulating.

They never responded. And they’ve been very resistant to having any interaction with me. But when I saw the NFT market emerge, it occurred to me that this was a natural medium in which to realize the point behind the piece, which was essentially that the art market has always been about selling security interests in the careers of artists. We just didn’t conceptualize it in those terms, because we were so tied to physical objects. But really a painting or a sculpture is a token in the same way that an NFT is a token. It’s a token for an entry in an artist’s catalogue raisonné. That’s the only reason why it’s valuable. Without that association, it’s just a dirty piece of cloth or a lumpy rock. It doesn’t mean anything at all. But if we think about it in that abstract way, if we remove the physical from the meaning of the art object, we can think about it as a signifier of a security interest in the future commercial goodwill associated with an author. That’s generalizable to anything. It doesn’t even necessarily have to be a work of authorship. It just has to be something that people think is interesting. I think that is a weirdly revolutionary shift in our perception of what it is that we’re doing when we engage in investment speculation and financial markets.

DE FILIPPI You can call it as you like, but basically the purpose of the NFT is to be purchased and resold.

FRYE Sure, the same as a share or a bond.

DE FILIPPI Whereas most of the time, when people are acquiring a license for a copyright work, they are doing that because they want to make use of that work.

FRYE But that’s just not true. Any publisher or music production company is purchasing copyright interest in a whole range of different works. Some of them will be valuable, some of them won’t. They’re speculating.

DE FILIPPI You’re using the world speculation in a very loose manner. A publisher doesn’t purchase the copyright to hold it until some other publisher might want to purchase it from them. They want to make use of the work. Of course they are hoping that this work will be popular so that they can earn profits when selling their published copies.

I agree with you about the value of eliminating the middleman. But I don’t think NFTs are contributing to that. I could make a DAO and ask people to send me money to make a movie. The movie doesn’t need to be an NFT. The added value of blockchain technology exists independently of whether my work is an NFT or not. The difference is that, if my work is an NFT, that enables people to engage in the speculative mechanism that was not possible before.

FRYE But that’s the innovation.

DE FILIPPI I get it. This is the one real innovative aspect of NFTs. There’s not much more to it than that.

FRYE Enabling speculation on the value of works of authorship—for me, that’s a fundamental shift.

DE FILIPPI It’s a fundamental shift for digital artists, whose works couldn’t be used for speculation until now.

FRYE But this at least signals that it’s possible to do the same in other areas.

DE FILIPPI Which areas?

FRYE Any.

DE FILIPPI Every physical work of art already has the capacity to be used for speculation. But if you want to speculate on a digital item, you need to create scarcity and you need to create authenticity. NFTs give this capacity to digital works, which is new, but everything else already has it, and has been using this capacity for a long time. That’s what the art world is about. As long as you have scarcity, you can speculate. You can buy a very rare copy of a book, perhaps the only copy that is signed by the author, and that makes it a potentially very interesting speculative asset. But if you have a publisher that is publishing millions of copies of the same book, you cannot speculate on these copies. And that’s great, because I don’t want to live in a world where we have just one million-dollar copy of a book sitting in a museum. I want to live in a world with an infinite amount of copies of the book, because everyone should be able to read it. I don’t want to create this artistic aura around a particular literary work

FRYE Yeah, no. This is exactly the opposite of what I’m saying. My point is there’s no reason we need to have scarcity of the work of authorship if people are willing to invest in the future commercial goodwill of the work of authorship itself. If somebody writes a book and sells fifty NFTs of the book, the buyers are speculating that people are going to think the book is cool in the future and want to be associated with it. For me, that’s what is really interesting about NFTs. They say that the economic value is in that fractional ownership or the relationship to the work of authorship, not controlling the work, but just having that relationship itself. If people value that alone, then we don’t need copyright anymore.

DE FILIPPI Well, perhaps we wouldn’t need copyright for that particular purpose, which is providing funds to artists.

FRYE Exactly. What else do we want it for? I mean, if we want it for controlling speech, then that’s fine. We should have a conversation about controlling speech then. But if the purpose of copyright is to fund a market in creative works and solve market failures in the production of works of authorship, then that at least suggests we have better tools available to us and maybe we should think about how to use them.

Copyright prevents people from using works in economically productive ways down the road—all the benefits that come with the public domain and people having easy, free access to everything. That’s the dream of the internet as a universal library.

Now I acknowledge that as you say, that’s not the only way that people think about copyright. People have all kinds of moral investments in control of the use of works of authorship and NFTs don’t do anything to address that. Maybe we should be having a conversation about what values we support. Do we want authors to be able to control how people use their works in the future? Is that consistent with speech values? That strikes me as an interesting and important conversation that in many respects is eclipsed by the economic conversation over copyright ownership.

DE FILIPPI I don’t think that the speculation on the items of a work will necessarily replace the type of commercial exploitation that we do on the expression of the work. You will always have actors eager to monetize the copyright in a work. And as long as this can provide additional economic return for the artists, artists will be willing to license those copyrights.

FRYE As a practical matter, I think I agree with you. Copyright law, what I call a landlord theory of authorship, is a really sticky concept. What’s interesting to me is why we feel like we need it and why we internalize the landlord values that come along with it.

DE FILIPPI In order for your argument to hold, you need to find a reason why copyright is not needed in the physical world. You’re saying that now that we can sell digital copies of artworks, we don’t need copyright anymore. But my response is that we have been able to sell physical copies of artworks and yet we’ve decided we need copyright. Why does the fact that we can now sell items in the digital world mean that we don’t need copyright anymore?

FRYE This is a reaction that a lot of people have. But the creation of copyright in the first place was a response to a perceived need to create a legal regime in order to facilitate investment in the production of works of authorship. Prior to the printing press, there was no copyright because there was no point to it. There wasn’t a market available. And therefore copyright was a response to the emergence of the new technology that facilitated a market that hadn’t previously existed. And I think that’s what we’re seeing today, right? As you say, this kind of phenomenon had always been theoretically possible.

DE FILIPPI Not theoretically. It has actually happened.

FRYE It happened in certain contexts, like in the art market. But for some reason it didn’t happen in other markets, even though it was theoretically possible. Now new markets are emerging, and for me that seems like evidence that something interesting and important happened. And I want to understand why.

DE FILIPPI I’m very curious to understand why this is happening as well. I think I have an intuition, which is pure speculative dynamics.

FRYE I’m 100 percent in favor of speculation. I think speculation is amazing. Speculation is what makes markets exist. And the fact that it’s possible to speculate means that we’ve now created a market that couldn’t have existed without the possibility of that speculation. That’s kind of amazing. Before copyright, before the printing press, it was not possible to speculate in the production of works of authorship in the relevant, modern way. The introduction of the printing press technology made it possible to speculate in the future value of works of authorship.

DE FILIPPI Do you agree that it’s a very different type of speculation? Buying something only in order to resell it is a very different type of speculation from buying something in order to commercially exploit it.

FRYE I agree that the industry is different and the means of recovery are different, but from a purely economic perspective, who cares?

DE FILIPPI The first type of speculation has no social value. It only provides money to the speculator. The second kind is productive.

FRYE It’s also providing value to the authors. Before the introduction of the printing press, there was no commercial market for authorship.

DE FILIPPI Now you’re defending copyright!

FRYE I am. Copyright was a really beautiful tool at a particular point in time. But maybe we don’t need it anymore.

DE FILIPPI I strongly believe that we don’t need copyright. We probably never needed it in the first place. The idea that artistic creation will not happen without copyright is insane. And I believe that the incremental innovation that would have emerged in a world without copyright would have created just as vibrant a cultural landscape as what we have today. So I’m not saying that we need copyright. But in order to remove it, we need to come up with an argument that holds against it. And I’m not sure that NFT alone is enough.

FRYE Unfortunately, I reluctantly agree that it might not be enough. I think people want more control. They want ownership. They want to be landlords.

DE FILIPPI If they want copyright, we must give them something that they want even more. An alternative system that will make them richer than the traditional copyright approach. Perhaps you will lose control over who remakes your work, but you’re going to make a lot of money instead. So suddenly there’s something you can choose between. Maybe some people will prefer to remain landlords and retain control over their works. But our hope is that more and more people will agree to move into the next stage of less control and more money.

—Moderated by Brian Droitcour