Wassim Alsindi & Max Haiven

Two philosophers discuss the time regimens and class politics of the blockchain, and how these concepts can help us understand art on Bitcoin.

What kind of critical language can be used for understanding crypto markets? What are the ideological foundations of these technologies and communities? Do the critiques developed by theorists to address dominant institutions apply to phenomena developing at the margins? These are some of the questions that the writers and thinkers Wassim Z. Alsindi and Max Haiven grappled with in a conversation convened by Outland to address Ordinals and how existing critiques of Bitcoin and tokenized art might be applied to them. Alsindi is the founder of 0xSalon, a nonprofit initiative that organizes events and residencies for scholars and artists working critically with digital culture. Haiven runs the Reimagining Value workshop, which develops interdisciplinary methods of thinking about social justice and decolonization.

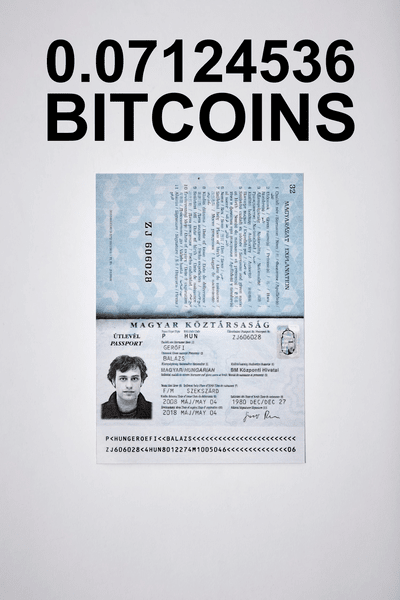

Haiven kicked off the conversation by reflecting on his 2018 book Art after Money, Money after Art, about the various ways in which the value created through social activity is captured; in the book, he engages with the concept of encryption but avoids an in-depth analysis of cryptocurrencies. This led to a discussion of crypto’s promise of an exit from a global economic system that is hostile to all but the wealthiest people on earth, how crypto appeals to people on the right and left seeking such a way out, and the challenges and risks of building systems that are radically different from the ones we have. The conversation is illustrated with images from Bitcorns, a financialized game that uses the Bitcoin-based protocol Counterparty, and Ordinal Miners, a series of AI-generated fantasy portraits of crypto miners. These projects play with agricultural and industrial imagery in ways that resonate with Alsindi and Haiven’s discussion of the class politics of blockchains. The illustrations also include cards from FAU0X SALON, an RPG deck created by 0xSalon.

MAX HAIVEN Let me begin by confessing that I’m perhaps not the most knowledgeable person to ask about the actually existing manifestations of emancipatory blockchain politics. I sense that the move toward blockchains is in many cases part of a broader tendency in our moment of rapidly decaying hypercapitalism toward a seemingly disconnected archipelago of ideological spaces. We appear to be seeing the rise of micro-utopias and semi-fictional heterotopian spaces in a wide variety of forms. For all we know, some people might have an entire intentional community of thousands of people running on some blockchain-backed technology or some other distributed finance mechanism. I doubt it, but it’s possible.

When I trained in the 1990s and 2000s as a cultural theorist, I think we still imagined these as subcultures, but something has fundamentally shifted because of the affordances of new digital technologies. I don’t think there is a mainstream anymore as we once imagined it, and I think we’re only just now becoming aware of the full implications.

I don’t think that I was necessarily wrong in my assessment of the political potentials of blockchain technologies and cryptocurrencies in my book Art after Money, Money after Art. But I do regret that I failed to recognize that these technologies defined a generation of radical thinkers on what we once might have imagined to be the left and on the right as well. I do think in hindsight we will need to contend with the fact that these technologies represented an attempt at liberation from the neoliberal capitalist machine. It might have been—and in many cases I think it was—a liberation through doubling down on the fundamental value paradigms of the neoliberal capitalist machine, to try and take revenge by going even further into them. Nonetheless, I wonder if I made a mistake in not recognizing that these technologies were meaningful for a lot of people and that they would define a whole generation’s way of thinking about things.

WASSIM Z. ALSINDI A lot of people talk about these technologies in terms of the empowerment of the ability to exit from whatever greater whole we might imagine. From what you’re saying, the exit could have already been realized to such an extent that we don’t even have a clear view on the outcome or the process which brought it to bear. People could low-key just be “doing it.” Perhaps the emerging discourses and movements around “network states” are a sign, or harbinger, of such exit phenomena.

HAIVEN You have to be a pretty special person to imagine that the system we have right now on planet Earth is good for anyone except a bunch of horrible billionaires. Everyone is looking for a way out. The problem is that this system presents a proliferation of exits that aren’t quite exits. To bring this into a different register, I’m working on a book right now called The Player and the Played: Gamification, Financialization, and Anti-Fascism. What do you do when you’re trapped in a game that you know is unfair, but every time you leave the game you find yourself in another game? The paradigmatic pop-cultural examples of this are The Hunger Games (2012)or Squid Game (2021). But the trick is, even if you are trying to escape and play a different game, chances are the new game you’re going to make will look a lot like the one you just escaped.

ALSINDI Part of the problem is that the technoeconomic structure that we are living within defines our concepts of space and time to an extent that it’s extremely difficult to conceive of anything fundamentally different. There’s a line of thought that comes through Fredric Jameson, Mark Fisher, and Slavoj Žižek that suggests it is easier to imagine the end of existence as we know it than a change to today’s capitalist conceptions and modalities. In my critiques of Bitcoin I’ve linked the zeal for decentralization and autonomy and the scarcity of commodity-money to the intensification of this “neoliberal deterritorialization” condition, through the downregulation of absolutely everything into a value judgment. It’s markets all the way down.

Bitcoin, primarily through the engine of proof of work, renders explicit the relationship between time and money, and for this reason I refer to the data structure that underpins the whole network as the “timechain.” Satoshi Nakamoto used the word “timestamp” fourteen times in the nine-page whitepaper. They designed Bitcoin as a decentralized timestamping system with incentives to keep in check the various stakeholders of the network, so that the order of the series of occurrences that have been posted to the grand record of the timechain have a high likelihood of existing in the future. Satoshi themselves referred to the data structure of Bitcoin as a timechain in early versions of the client software—as comments alongside code—before the network launch in January 2009.

The actions by which Bitcoin synthesizes its historicity are a fundamental break from the calendric time-producing, timekeeping, and time-measuring systems that are based upon the location of the Earth in the heavens. Through proof of work—the incentivization of massive amounts of brute force computation that leverages randomness to find particular results of mathematical operations—Bitcoin gives rise to a new temporal regime, completely divorced from everything that has come before. As I have written elsewhere, Bitcoin’s timechain is not merely a clock. It is more-than-clock. Bitcoin contains within it an idiosyncratic logic of time, as well as giving us the ability to measure the passage of time in relation to it.

Having the capability to decide the order of events in this, or any, timekeeping system gives one power, often exercised through the extraction of value by the marshaling and channeling of time’s flow. There’s an analogy we could draw here to the heavily politicized distribution of time zones and timekeeping standards such as GMT, which were created to work in the service of European colonialism and imperialism.

Weirdly, it is possible to measure Bitcoin’s value purely in terms of time. In every Bitcoin block there’s a reward allocated to the miners, which coincidentally just readjusted from 6.25 BTC to 3.125 BTC, roughly every 10 minutes. If you divide the time per block (600 seconds) by the reward per block (3.125 BTC) you get a lower bound on the amount of time that 1 BTC buys you in terms of the thermodynamic security of the network, which equates to 192 seconds as of May 2024. So, we have redefined a unit of money purely in relation to time. I’m told by analytic philosophers this is termed a Ramsey sentence, a self-complete statement that connects science to metaphysics.

HAIVEN I’ve been thinking about attempts to update Marxist theories of value for the twenty-first century. A lot of the struggles we’re seeing right now in the digital economy have to do with capitalism throwing out time as a measurement of value. Look at the gig economy. As workers, you’re not paid by the hour, you’re paid by the gig. You’re paid what the market will bear for completing a task. If you’re an Uber driver, there is some indexing of your labor to the amount of time you spend driving a client in a car, but actually you’re getting paid based on completing the task, not the time it took you to do so. Marx himself talks quite a bit about how, during the industrial revolution of the nineteenth century, workers struggled to be paid by the hour, rather than by output, because it almost always serves workers’ interests to be paid for the amount of time that they are actually being forced to sell to the boss. One of the dynamics we’re seeing right now is a return to an economy where people are paid by output.

In the early 2000s, theorists like George Caffentzis, Harry Cleaver, and Massimo De Angelis were writing about capitalism as a field of struggles over measurement. Capitalism has a relentless drive to turn humanity’s creative cooperative into surplus value, and it can do that by imposing different forms of measurement in various places. They encourage us to see how the struggles of the exploiter and the exploited circulate around how things should be measured. So, for example, the Amazon warehouse workers and drivers I work with in the Worker as Futurist project (2022—) are struggling not only for better wages and working conditions, but also against the algorithms that are using all sorts of harvested data in order to measure worker productivity and then deploy punishments and (less often) rewards. In plenty of other industries, our ongoing digital revolution is facilitating capitalism to harness and discipline work beyond simply clock time. So to assess class politics of blockchains, maybe we could think about how time functions as a unit of measurement on them. Does that bring anything to mind for you?

ALSINDI It is ringing some bells, yes. Who sets the clock in a factory? That person or entity controls the means of time-keeping, perhaps now even the means of temporal production. Famously, factory owners would fiddle with the clocks to extract more time from workers’ shifts. But that’s the past, before the proletariat acquired the means for decentralized temporal autonomy. How might people manipulate time to their advantage in the future?

When I said that the Bitcoin clock is not at all attached to the Earth clock anymore, I lied slightly. Sorry. There is one tenuous connection: when miners find a block, they include within it a digital timestamp which needs to be within a certain range of recent blocks in order to prove that they’re not playing tricks. I’ve written about “time-warp” attacks that can be done by messing with timestamps to gain advantage in proof of work networks. There’s also something that has become commonplace on Ethereum—which is also theoretically possible on Bitcoin—called “miner extractable value” or MEV. Simply put, the network participants who create the blocks (validators, miners, etc.) are producing the historical record of the network, giving them decision-making power over what actions go into the blocks that they make. By having a network-wide view of unconfirmed potential transactions, block builders have a sixth sense from reviewing other actors’ profitable proposals which might be token trades, cross-chain arbitrages, flash loans, and so on. Block builders can put their own version of a transaction in the block that they’re mining, claiming all the profit for themselves without risking much if anything. There are a number of forms of temporal manipulation possible in these systems, partly as a result of how the systems are architected—toward decentralization and permissionlessness—but also partly because of the way that we’ve discretized time in these systems.

HAIVEN It reminds me of these apocryphal tales of totalitarian regimes where they go back and say that the brilliant leader invented the wheel and fire. They re-narrate the history of progress in order to justify the present balance of power.

ALSINDI We reinvent the wheel so that we’ve got something to turn all the old ideas around on, again and again. Post-clock rationalizations, some might say.

HAIVEN Ordinals use timestamps as verifiers of nonfungibility. Does this make them different from other forms of tokenization?

ALSINDI Let’s start with a little disambiguation. In some of my writing on blockchain theory I talk about this production of Bitcoin’s historicity as ordainment of a series of ordinalities. There’s a kind of divine sorcery (ordainment) implied in the phraseology we use in relation to how Bitcoin transactions are enshrined within blocks and canonized in this eternal ledger. As we said earlier, the order (ordinality) of occurrences is the most important thing in the Bitcoin network. By discretizing everything, putting network actions into blocks and batching them on the timechain, Bitcoin gives us a high degree of assurance on the order of this series of events, which is secured by the massive amounts of energy going into proof of work. Ordinals are interesting conceptually because they’re a metaprotocol, providing a subjective and selective view of the Bitcoin network that is not shared by all, by representing certain parts of the Bitcoin supply as different and distinct from other parts of it. It’s kind of a (de)fungibilizing tool, creating a meta-fungibility. Ordinals theory purports that some satoshis–the minimal units of Bitcoin–are more or less special than others. Imagine you have a jar of pennies, and the top penny in every jar is a special penny, but most people don’t see that the penny is special. It’s in some ways like a hologram that some people can see and others can’t. Or those amazing glasses in the movie They Live (1988).

There’s a historical arc predating this idea. Other people have tried to make some pieces of Bitcoin look different from other pieces of Bitcoin. The first conversations about Colored Coins happened in 2012. They used the OP_RETURN metadata field for Bitcoin transactions to house a small amount of extra information. People started using that to distinguish some fragments of Bitcoin—which we call unspent transaction outputs, or UTXOs, for short—from other fragments, therefore ‘coloring’ them in a way. Using a different piece of software, they could then be represented as a different token. You could embed arbitrary data, to an extent. Tokenizing stuff on Bitcoin became easier using OP_RETURN and other related “metadata” methods. The thing that sticks in my mind is the Bitcoin-based Counterparty meta-protocol, which in its heyday from 2014 through the beginning of the NFT buzz and boom in 2019 was a breeding ground for people making all kinds of proto-NFTs or weird little token projects. I see Ordinals as a return to this idea of twisting Bitcoin to do something different than the narrowest visions.

HAIVEN It sounds like nothing prevents the proverbial top penny in the jar from circulating completely independently. The person who owns that Bitcoin doesn’t have any particular say over what happens with that Ordinal associated with it. Am I correct in saying that?

ALSINDI If you run the Ordinals protocol software you can specify which satoshis get spent or don’t get spent. That gives you the ability to keep the special pennies. You put on the They Live glasses and see things as they really are.

HAIVEN Gotcha, okay.

ALSINDI For me, the most interesting aspect of Ordinals is not the art itself, which largely mirrors what happened in NFT culture of the last few years, perhaps speedrunning it. It’s the demand generated for transactions on the Bitcoin blockchain by this new network activity. Ordinals put all the data—image, text, code, whatever—into the Bitcoin blockchain, not just a hash or some other concatenation. The usual goal is to keep Bitcoin transactions as small as possible, because real estate on the timechain is the truly scarce resource at play. Now there’s a new category of demand that wants to put high-value Ordinals transactions in the Bitcoin blockchain, and that bids up the transaction fees across the whole network. Including these transactions should be a welcome boost to the Bitcoin network. On the other hand, some people think Ordinals are an inane mirage, somewhere between junk data and a DDOS attack on Bitcoin, which purists maintain is supposed to be used solely for financial transactions and absolutely not monkey jpegs or frog memes.

HAIVEN So to believe that Ordinals are a good thing, you have to believe that Bitcoin is a good thing, and you have to believe that what’s best for Bitcoin is greater incentivization for miners, and you need to believe that the development of this Ordinal layer is the best way of producing incentives for miners. Is that correct? I’m trying to understand whether there’s a motivation for this beyond the competitive needs of people who want to hold digital assets.

ALSINDI Pretty much yes, but Ordinals don’t necessarily have to be the best way of creating this motivation, at minimum it’s enough for it to be perceived as net positive. We shouldn’t forget the renegade/anarchist cypherpunk narrative in which Bitcoin has its origins. There are people who have been in Bitcoin for a very long time, including people who were already active when I showed up in the early 2010s. We all watched the normie finance guys, Wall Street stockbrokers and California VCs, show up over the years and recruit people from the community underbelly into the establishment. The people who used to hang out with us clowning around at seemingly inconsequential conferences ten years ago are now talking heads on Bloomberg, or they’re in government. This weird, raggedy community movement that was around Bitcoin until around 2016–17 felt like something quite earnest. As the financial stakes increased, other groups of people with more straightforward incentives showed up. I’m always interested when I see something that looks like a genuine community that hasn’t been astroturfed owing to artificial economic incentives or by influencers pumping a particular narrative or asset. With Ordinals, there’s a bunch of Bitcoiners who see this as a fuck-you to the overly sanctimonious Bitcoin developers of old, and their puritanical ideas of what should or shouldn’t be a Bitcoin transaction. In some ways it is the classic story of rebels who didn’t like the way the protocol was going and decided to do something about it. Though I don’t know if the reality is quite so emancipatory as that.

HAIVEN Again, the romance of exit.

ALSINDI And it’s all predicated on scarcity once again. We could be imagining much more ambitious futures, better futures, and very often the ones that come to be within our grasp are never radical enough, if at all.

HAIVEN I think It goes back to the metaphor I was toying with earlier—when you exit a game and try to make a new game often, the new game looks a lot like the old game. Ordinals, like NFTs before them, potentially open up a different way of transacting an artistic product. But is that just a different game that looks like the other, bigger game? Or is this actually a substantially new arena? Does this advance the power of artists as workers? At the moment I can’t see how it does. I don’t see how it would serve artists who would wish to be in solidarity with other workers. I can see how it would advantage artists to the extent that they imagine themselves as neoliberal entrepreneurs. But I’m open to being convinced otherwise!

ALSINDI The brutal reality is that when we use these blockchain-based systems to bootstrap networks or token economies, we’re in the business of building enclosures. We’re splitting and siloing everything, and that’s anathema to solidarity. Last year I went to a blockchain conference called “Funding the Commons,” and at one point somebody on stage misspoke and said “finding the commons.” I thought, yes! If you find some here, let me know. We’re hardly ever creating true solidarity frameworks with blockchains. The technology substrate we’re using makes it so difficult to do that.

HAIVEN And what would make that possible?

ALSINDI I’m not sure we even know what an actually existing technological solidarity could look like. But there are some projects gesturing in that direction. Circles, a prototype for universal basic income on the blockchain, has been in development for a long time. I can’t say if every human on the planet will be using Circles UBI in the future. But at least it opens up a design space and shows people the capabilities and requirements of a viable system for universal basic income. Another is Breadchain, which is trying to use blockchain as infrastructure for workers’ co-operatives. The post-capitalist economic method that they’re trying out at the moment is communal staking. Community participants put up their assets as low risk collateral and there’s some pseudo-interest paid on those, which is used for solidarity projects.

HAIVEN One of the things that’s exciting about these new technologies—to go back to my opening comments—is that they open a space for imagining there are other ways to organize our cooperative creative energies. There have been interesting experiments and conjectures. But almost all those projects run into very significant problems either in the ideology underlying their design or in terms of their ability or plausibility to scale up to actually change anything substantial. Be that as it may, anyone who’s interested in these technologies and the prospects of freedom should also, I think, be very interested in destruction, and how these technologies can do as much damage to the corporate capitalist infrastructure that exists as possible.

Ultimately, the problem with our world probably is not that we don’t have enough ideas about how to cooperate differently or create new systems or currencies or platforms to make it possible for us to cooperate differently. The much bigger problem is a billionaire class and their functionaries who are taking the world’s wealth and running the planet into the ground. These people’s wealth and institutions should be destroyed. How can blockchain technologies be used as a force of destruction rather than creation? We need to talk about that openly.

ALSINDI I think we could weaponize blockchains to be a force of destruction as well. I feel like it’s one of the last use cases we haven’t tried.

HAIVEN Why haven’t people tried it?

ALSINDI Well, I suppose people have used it to destroy their own money. We can also use it to destroy fragile ecosystems—such as our planet’s—as well. That’s well documented.

HAIVEN I remember talking to someone in the early 2010s, back when there was this early optimism for Bitcoin, and he said it was possible to set up a system which would pool people’s crypto and create an auction for people to perform radical actions. If you wanted to leak industrial secrets from Shell or you wanted somebody to sabotage a factory, you could crowdfund online using this anonymized technology to pay someone to undertake that action.

ALSINDI Sounds great. In the ’90s, the activist collective RTMark acted as a distributed platform to crowdfund subversive public actions, and I don’t think we see enough of that sort of thing today. Because crypto is unregulatable at the technological level, it creates natively gray or black markets for all kinds of financial activity. In 2014, !Mediengruppen Bitnik made a random darknet shopper that would use Bitcoin to purchase items on the Silk Road and have them delivered by mail. Laws were being broken, but by whom? The bot? The random-number generator? The developer? The cryptocurrency? The conceptual artist?

HAIVEN There’s a lot of talk about governance and new forms of governance. These days I’m mostly interested in ungovernability.

ALSINDI I do have a big worry as to where all of this governance larping and cosplaying is going. As the amount of capital driving “governance projects” rapidly increases in scale, these projects begin to look like ungovernable zones that can have real impact on everything else in the world that we live in, for real. We don’t know how ungovernability on those scales in our highly integrated, interdependent capitalist lifestyles would manifest. We don’t know what the consequences would be.

—Moderated by Brian Droitcour