Twitter’s metaverse play

Jeffrey Alan Scudder discusses the new social hierarchies that web 2.0 platforms could be building for the metaverse.

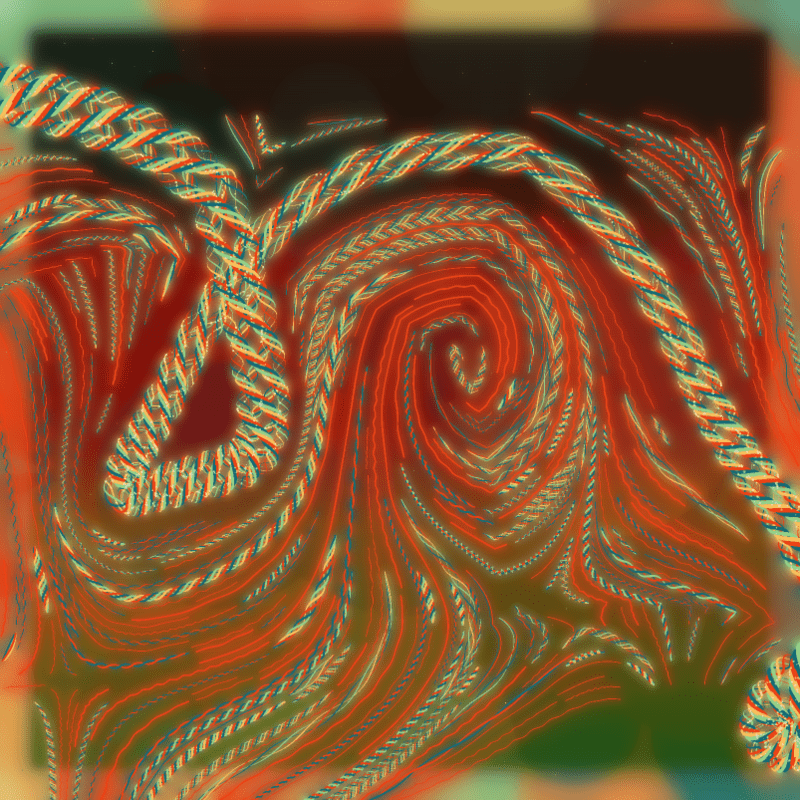

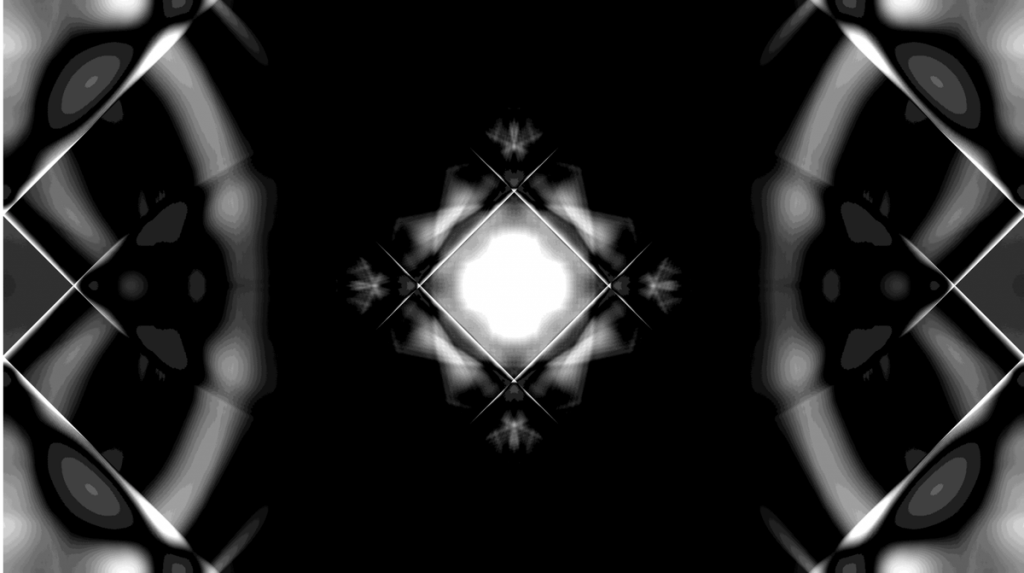

Quantum Leap (2021) by Kevin and Jennifer McCoy is a series of eight generative NFTs with a three-year life cycle. Each token produces a mandala pattern from geometric polygons, which morphs, decays, and even generates descendent tokens over time, all following instructions that are coded directly to the blockchain. Collectors of a Quantum Leap original token also own the new derivative tokens and may display and trade them together or separately as they choose. The code that drives these animations lives partly on the Ethereum blockchain, accessible through a dedicated website. The complexity of valuing a work like Quantum Leap, which involves original and derivative tokens and requires wallet registration on a website, underscores the need for appraisers to build standards for the valuation of NFTs distinct from the appraisal of traditional works of art.

Even describing and cataloguing such works is difficult under the existing systems that appraisers are required to use, such as the Getty’s Object ID standard, which includes categories like measurements and markings that are difficult to translate, if not altogether irrelevant, to digital assets. Rather, for an NFT, a detailed description would require an account of the artwork’s economic, financial, and technological context. In the case of Quantum Leap, the artists do not have control over future token activity. With other projects, appraisers may wish to consult with the artists to analyze the design and birth of subsequent generations of tradable tokens or any other attributes and events generated after the creation or the acquisition of the NFT.

Conservators of time-based media art (TBMA) have laid a foundation for understanding the technological construction of digital artworks. While conservation is generally considered distant from the market, conservators’ knowledge of how to reverse-engineer the artistic process could be useful to appraisers. The market for NFTs necessitates verification of digital provenance, which often requires both detailed understanding of the technological structure of an artwork and disinterestedness—that is, distance from an incentive to sell the work. Appraisers can draw on some of the systems developed for media art conservation and otherwise collaborate with technological experts in order to solve for what we term the “audit problem.” We define the audit problem as the need to forensically trace minting, to technologically confirm the trail of decisions the artist has made, and to verify the digital provenance, all performed by a party with the independence required of auditors in financial circumstances. This need for objective expertise to parse an NFT’s provenance becomes particularly acute in cases where an NFT has been moved from one blockchain to another. For instance, the DADA Collective had to remint its pioneering collection of crypto collectibles, the Creeps & Weirdos, as ERC-721 in 2019 because they had originally been made in 2017, when only ERC-20 was available. This resulted in two different sets of collectibles, and appraisers must understand how the difference between the ERC-20 and ERC-721 versions drives the determination of the appraised value.

This imperative to solve the audit problem brings together two key aspects of the burgeoning NFT space. First, artists are taking on a central role in the market, bypassing galleries to release works through auction houses and NFT platforms. As a result, the institutional authorities that appraisers have traditionally relied on play a lesser role. Secondly, because NFTs are both artistic and financial objects, it is hard to consider these artworks apart from their market footprint—the platform where they are displayed and sold, the attached artist royalties, and the role that royalties have in a rapidly changing part of the art market. This context can be described as the artwork’s economic provenance, a concept that this essay’s co-author developed through her research into the sales history of Jasper Johns. NFTs require an interdisciplinary appraisal practice that takes into consideration factors both intrinsic and extrinsic to the artwork. Art history rarely includes an artwork’s economic means of production, but NFTs bring ownership, commercial licenses, and resale royalties to the fore.

Art history rarely includes an artwork’s economic means of production, but NFTs bring ownership, commercial licenses, and resale royalties to the fore.

Purchasers of NFTs may have a variety of exhibition rights, financial rights, and governance or voting rights. Depending on the platform an NFT was acquired, there may also be limitations on these rights. If an NFT offers commercial rights, an appraisal needs to follow an income approach. For example, Yuga Labs’s Bored Apes Yacht Club (BAYC) offered Ape holders full commercial rights, while Larva Labs originally limited CryptoPunks owners to $100,000 in annual profits. (Yuga Labs acquired the IP rights of CryptoPunks in March 2022 and announced that Punk holders would be given full commercial rights. That these rights may change over time enhances the complexity.)

Moreover, the NFT market contains a wide variety of hybrid forms that challenge existing norms among appraisers toward specialization. Appraisers accustomed to focusing on a particular area or genre may encounter enormously different works in the NFT space. A Bored Ape is a far cry from a conceptual work by Rhea Myers, or an AI-based digital work by Helena Sarin. Appraisals may require more collaborative approaches that span the expertise of various specialists, not only in the arts but in adjacent categories of design and computer animation, especially as some design works are being legitimized as art. Among the one hundred highest NFT auction prices of the year 2021, Artprice counted sixty-five artworks, thirty-two collectibles, one film sequence, and two “digital zones,” which are artifacts of a conceptual art project by Mitchell Chan. This crossover of art, design, and gaming categories affects the parsing of NFT market data. For example, Nonfungible.com has designated Cryptokitties—an early project exploring the potential use of ERC-721 tokens as gamified collectibles—as art, which skews our understanding of the category when industry or academic researchers try to understand the size and shape of the NFT art market. This understanding of the larger market is important context for the appraisal of individual NFTs.

The audit or independent appraisal of an NFT can encompass many other factors, including storage of the NFT’s linked image files and their potential obsolescence. Given that the content and metadata that most NFTs represent do not live on the blockchain, the technological due diligence performed by conservators becomes essential to vetting their financial value as works of art. Links may go dead, which can be highly consequential to an NFT’s value. Consider a representative case: Love in the 4th Turning (2022), an AI animation by Claire Silver, which was minted from the OpenSea wallet on the platform’s shared smart contract. The animation itself is stored on an off-chain server, an entity that handles management and data processing functions. Smart contracts that govern NFTs such as Love in the 4th Turning on the Ethereum blockchain specify the location of the metadata using a token Uniform Resource Identifier (URI) function. When this function points to a centralized storage location such as Google Cloud or Amazon Web Services URL, the appraiser must consider the risk of losing the asset if those services were to go offline or be redeveloped by Google or Amazon. This could potentially happen with Love in the 4th Turning, depriving the NFT owner of the asset. The appraiser must evaluate the financial risks of entrusting these files to the centralized servers of large companies.

Over time, both best practices and new forms of insurance may evolve to address the difficulties of modeling risk into an appraisal valuation. Storage may seem unrelated to economic provenance; however, if someone is not paying to steward and store the work, its value is wholly at risk. Thus, storage becomes synonymous with insurance, as both are forms of managing risk. Who should pay is not clear: in the case of traditional, physical artworks, the collector is responsible for storage, insurance, and other related costs associated with the work’s maintenance and preservation, but caretaking standards for NFTs are not yet established.

Various interdisciplinary methods from TBMA conservation offer frameworks for weighing the trade-offs of artistic intent and both hardware and software obsolescence. Conservators have built encrypted systems to store files for digital art that share encryption standards—e.g., SHA-256, a hash algorithm—with blockchain itself. The difference is that conservators store works off-chain, though existing practices may be adapted to NFT appraisal standards to register the artworks on chain. In addition, standards for storage need to include back-up in decentralized servers and in an interoperable formats, such as in distributed off-chain storage like the InterPlanetary File System (IPFS) and Arweave. For example, artist Peter Wu+, the creator of the project EPOCH, produced a series of virtual exhibitions that are minted on the Algorand blockchain and sold as NFTs. Materials constituting the works and metadata are all stored on IPFS using two different gateways pinned by both Pinata and Uncopied, thus allowing data to be safely secured and moved. In this case, an appraiser may reasonably rely on the permanence of the asset. The appraisal field will need to decide the significance of storage practices, obsolescence risks, and other parameters of NFTs as artworks. Much as conservators have already had to weigh obsolescence and artistic intent when dealing with media artworks employing outdated hardware—for instance, how to replace components within video installations by Nam June Paik incorporating monitors that are no longer manufactured—appraisers will need to understand how restoration, reminting, or maintenance risks affect the value of an NFT.

Storage becomes synonymous with insurance, as both are forms of managing risk.

These determinations of value likely require the ability to forensically deconstruct an NFT and to evaluate it on a case-by-case basis. If price histories of works minted and sold as NFTs are publicly available and capable of being tracked in real time, these market metrics need to be interpreted by appraisers individually. While there are some private start-ups, notably Appraisal Bureau, that are building proprietary valuation models for NFTs, it is also important to develop standard processes held in open-source. These standards should be accessible across the global community of appraisers and related experts, in alignment with the inherently decentralized nature of blockchain technology.

The lessons of TBMA conservation suggest an optimistic trajectory in the formation of appraisal standards for NFTs. Conservators have been organizing their work through multidisciplinary collaborations since the late 1990s. They have thus been able to pioneer methods to perform audits of digital works. These methods considered artists’ intent as well as museums’ responsibility to preserve the works in their collections. Both of those are relevant to the appraisal needs of the NFT market, centering artists and parsing NFT technologies in clear-eyed and rigorous ways.

Art markets have long relied on “institutional value”—that is, the imprimatur of critics or museums—to confer cultural value that can be translated into market terms. Now, the role of critics, curators, and connoisseurs is joined by another form of institutional value, one more attuned to artists and the ability to forensically understand their process of making the work. In the evolving technical world of blockchain-based art, these new conferrers of institutional value for NFTs are conservators. They join an expansive interdisciplinary list of stakeholders in the many forms of social, cultural, financial, and artistic value of NFTs. These stakeholders can together reflect the many non-economic forms of value—social, cultural, aesthetic—and attempt to create commensurability with the economic realities and rapid changes in the NFT space. The audit function fixes the economic values with some sense of objectivity while the presence of a wide set of stakeholders protects us from our limited understanding of value in both financial and larger artistic ways.

This is the second part of a two-part essay on developing appraisal standards for NFTs. Read part one, on digital wallets and establishing provenance, here.

Muriel Quancard is an appraiser of postwar, contemporary, and emerging art with a specialization in time-based media. Amy Whitaker is a longtime blockchain researcher and assistant professor at New York University.