Metaverse as Dark Forest

The prototypes of the CripTech Metaverse Lab suggest that virtual worlds can appeal to users by offering multiple ways of being online.

Where did NFTs come from? If you return to Satoshi Nakamoto’s 2009 Bitcoin whitepaper, you will notice that it doesn’t include the word “art.” While Nakamoto specifically proposes a “purely peer-to-peer version of electronic cash,” the text addresses itself to a wider conceptual scope. Its very definition of Bitcoin is premised upon interaction and cooperation: “We define an electronic coin as a chain of digital signatures.” Implicit notions of the social continue to run through the piece; Nakamoto invokes “the inherent weaknesses of [traditional finance’s] trust based model,” and says that Bitcoin allows people to “transact directly with each other without the need for a trusted third party.” Nakamoto suggests that money is always about more than just money; its value consists in the practice of its exchange.

Nakamoto suggests that money is always about more than just money; its value consists in the practice of its exchange.

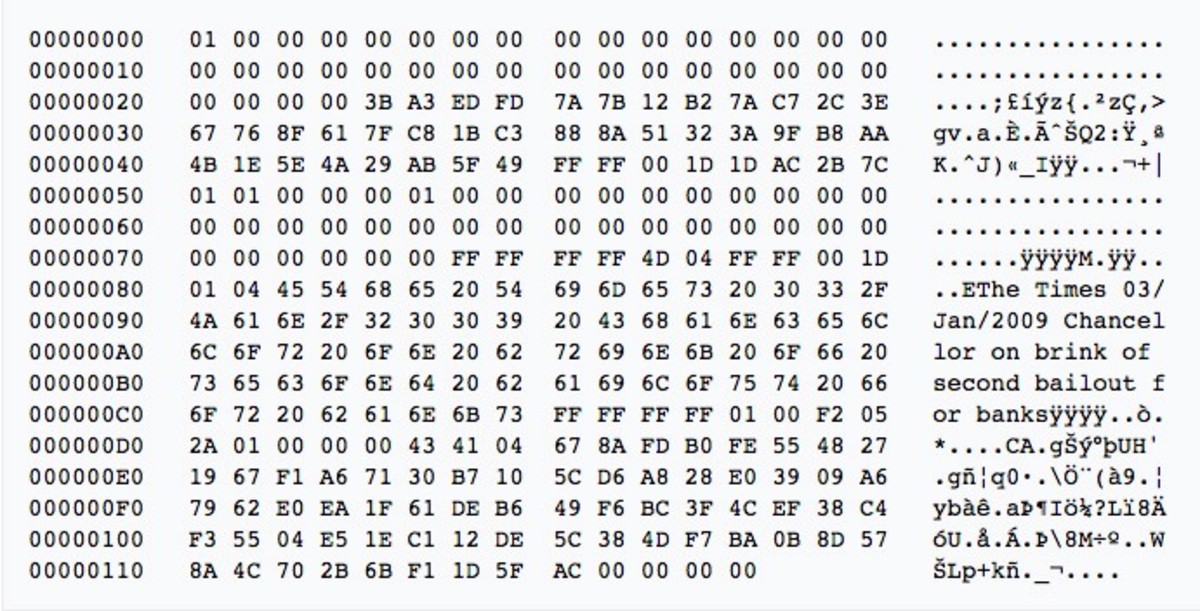

It is notable that Nakamoto’s definition of Bitcoin as a series of digital signatures explicitly evokes writing, as if hinting at the technology’s capacities for expressive, creative practice. Indeed, Nakamoto famously used hexadecimal encoding to embed an overt piece of political commentary within the very first block on the blockchain: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This message references a headline from the Times newspaper in the UK, obviously alluding to the wake of the global financial crash in what appears to be an effort to communicate the relative integrity of Bitcoin.

In the parlance of early Bitcoin developers, this message was a piece of “arbitrary information” because it was not essential to that first block’s functioning. Bitcoin was mostly used for simple monetary transactions in the early years, but many users found ways to interact with it in a more creative or “arbitrary” manner, embedding messages ranging from ASCII art and prayers in Latin to declarations of love. Fascinatingly, many of these messages were communicated through misuse of the blockchain, by embedding information in fake addresses or unspendable outputs, effectively wasting bitcoins in order to make a signifying mark on the immutable ledger.

In these early years, Bitcoin community members had many ideas about what was often referred to as “Bitcoin 2.0.” This term communicated the idea that the blockchain could be used for more than monetary exchange; maybe it could lead to new kinds of social relations and practices. In an influential 2012 blogpost, technologists Yoni Assia and Lior Hakim outlined technical specifications for a process whereby a Bitcoin could be technically modified so as to signify more than just money. Their idea was to create “colored coins” endowed with surplus representational functionality: by altering the metadata of a Bitcoin, users could assign it a contextually specific meaning. In addition to representing itself, a Bitcoin could also represent a concert ticket, shares in a company, or even an artwork. Platforms including Counterparty and Coinprism made this concept a reality, giving users the ability to create their own tokens on the blockchain, and offering functionality for the hypothetical representation of real-world commodities like stocks and bonds with tokens.

Maybe the blockchain could lead to new kinds of social relations and practices.

Of course, humanity’s earliest currencies were assets: gold, silver, shells, salt. A few millennia passed, and the use of currency to represent assets became commonplace with the rise of the gold standard in the nineteenth and early twentieth centuries. In this era, paper banknotes were not valuable in and of themselves, but because they could be exchanged for gold. Then, in 1971, Richard Nixon kickstarted the rise of financial capitalism by abolishing the Bretton Woods agreement, terminating the convertibility of the dollar into gold and effectively ending the gold standard. The successor regime of floating exchange rates was more flexible, facilitating the creation of new financial instruments and coinciding with broader trends towards the deregulation of financial markets.

With the end of the gold standard, money was no longer backed by physical assets, but by the authority and credibility of the financial system itself. Interestingly, this nominalistic value system finds parallels in the conceptual art produced around the same time. Works such as Sol Lewitt’s instruction-based Wall Drawing series or Robert Morris’ Card File (1962) explored the linguistic and performative capacities of art and showed you can make a piece of art by simply calling it “art.”

When the artists Nili Lerner and Sarah Meyohas published statements announcing the issuance of cryptocurrencies to represent artworks in 2014 and 2015 respectively, they utilized a number of well-known conceptual art gestures to make blockchain art history. Not unlike site-specific happenings or earthworks, the substance and archival memory of these works consists primarily in written and photographic documents, as opposed to physically delimited art objects. The artist statements accompanying each currency played a central role in shaping public perception of what the work was, while also circulating online as artistic media in and of themselves.

NILIcoin was announced in a sprawling, at times hard-to-understand post on the Bitcointalk forum in September 2014. Lerner says that the coin represents her entire oeuvre of paintings, allegedly valued at exactly 1,000,000 USD; she communicates an egalitarian spirit by committing to the redistribution of all proceeds from sales of her work to token-holders in the form of NILIcoins. Critiquing the way art collectors’ disproportionately profit from the traditional art market, Lerner argues that the “public which value[s] the work should be able to share profit.” “When I give you my NILI coin I give you a part in my art,” she adds. “You can even become part of the art it self. […] And with your BTC I may fly to the moon one day.”

The unrealized aspect of the project, a defi platform, is one of its strangest and most interesting components; Lerner also says that the NILIcoin ecosystem will function as a “sustainable alternative for the monopoly of bank credit.” In addition, she uses the statement to announce another pop art-influenced series of tokens-to-come including Disney Coin, Toyota Coin, and Apple Coin, designed to “illustrate how these industries should employ an altcoin.”

Meanwhile, in Meyohas’s original artist statement for Bitchcoin, she specifies that tokens “can be exchanged in perpetuity for Meyohas’s future photographic prints, at a fixed rate of 1 Bitchcoin to 25 square inches.” The statement is written in an FAQ style, and Meyohas conceptually links Bitchcoin directly to modern monetary history: “Bitchcoin is fully asset-backed, much like the former US gold standard, which once linked paper money to gold reserves in Fort Knox.” (Meyohas has a degree in finance and international relations from the University of Pennsylvania, and also got an MFA from Yale, one of the most prestigious programs in the country.)

Bitchcoin was launched in partnership with Brooklyn’s Where gallery on February 15, 2015, at the Trinity Place bar in Lower Manhattan. Pointedly, this location sits across the street from Zuccotti park, the famous site of the Occupy Wall Street protests. Not unlike Lerner, Meyohas uses these signifiers to characterize the project as an invitation to invest not just in art, but in something bigger. She says that Bitchcoin allows collectors to “invest directly in Sarah Meyhoas as a value producer rather than investing in the artwork itself […] It’s a bet on Sarah Meyohas with no expiration.” The artist also adds that the token gives her a stake in the “supply, demand, and price” of her own work.

What Lerner and Meyohas created were essentially DIY financial instruments as art.

What Lerner and Meyohas created were essentially DIY financial instruments as art. Their works highlighted the strange ways in which artistic production was imbricated in the contemporaneous financial system, through the rise of art investment funds in the 2000s, and the mature development of art securitization. While several of the artists’ theoretical claims are contestable, they do seem to intimate the financial system’s iteration and expansion in the near future through the NFT boom to come. Their works paint a picture of a world where it is hard to tell art and finance apart, yet the tone of their proposals has nothing in common with the left-liberal melancholy that typically attends (public-facing) art-world discussion of the topic.

Around the same time, artist Rhea Myers pushed the nascent representational abstraction of “art on the blockchain” a step further with the launch of a series of “Coin” projects. Art Coins, minted in January 2015 on Dogeparty to “represent different kinds of art,” seems to riff on the formal terms of color field painting. Myers created coins for a small set of colors—white, blue, red, green, and yellow—and defined what they symbolized both in terms of thematic content and geographical affiliation. White was “an eternal changeless epitome of art,” while yellow was “an art from New York and Berlin, found on blogs and made from obsolescent media.”

Myers also released Critical Coins the same month. Introducing the project with a statement of purpose, she claims that art criticism can be “made more transparent and quantifiable” by adopting crypto tokens as a means of self-expression. Myers gives critics just eight options for communicating appraisal: Critical Approval, Positive Critique, Negative Critique, and Star Ratings from one through five. On a certain level, Myers is trolling: art criticism would be worthless if relied upon such a limited, unnuanced lexicon, and conducted itself in such a transparently transactional manner. However, by ironizing the unspoken rules animating certain indisputable failures of contemporary art criticism, Myers highlights the limiting ways in which criticism itself is constituted as an asset that can be bought and sold. Her critique is not one-dimensional, though; Myers also seems to suggest that if dominant critical institutions leave something to be desired, then we might consider building new ones better suited to the task of critique.

It would be odd to deny that crypto has become a playground for some of capitalism’s most base impulses.

Lerner, Meyohas, and Myers earmark a unique moment in the history of reification—Marxist philosopher György Lukács’ term for the process whereby the commodity form transcends saleable objects and becomes a totalizing social logic, “the central, structural problem of capitalist society in all its aspects.” And yet, these artists saw creative and financial wiggle room in this new technology, albeit in very different ways. While the accuracy of their assessments is largely a matter of debate and personal taste, it would be odd to deny that crypto has become a playground for some of capitalism’s most base impulses.

Still, there is interesting, medium-specific NFT work being made today, as in the so-called “Avant NFT” zone, including projects such as Tojiba CPU Corp, Galerie Yeche Lange, and Card NFT on Solana. Works in this space are often collage-focused, juxtaposing memetic vernaculars from such a wide range of sources as to produce a sense of psychedelic apophenia. They perform second-order operations on first-order codes governing production standards within the mainstream NFT space, toying with the affordances of collection characteristics such as traits and rarity distinctions, while thinking through representational styles specific to the avatar or profile picture. Meanwhile, back in the traditional art world, works shown in traditional institutions doesn’t seem to be doing much to stem the flow of capital, so we might question its ability to cast stones. We live in a strange world.

Alexander Iadarola is a writer based in New York.