Fingerprints DAO

Curator Sam Spike discusses what it means for an NFT smart contract to be an artistic medium.

Last month the sale of a work by Carla Gannis, The Garden of Emoji Delights (2014), made a splash, breaking the record for the highest price achieved by a woman artist on Tezos. The sale of the C-print and NFT was facilitated by the Transfer Data Trust, a newly established nonprofit made up of a decentralized network of experts with the aim of improving the preservation, care, and valuation of digital art. This particular work was acquired by an anonymous artist and collector based in St. Louis, known only by the Objkt profile name of FoolishBoy. Over the past few years the collector has been quietly building the Fabric Media Collection, with a focus on digital artworks by women and emerging artists. Now, with the announcement of the Gannis sale and the subsequent launch of a website, FoolishBoy is ready to share more. Below is a text based on a series of emails exchanged with Outland, outlining the genesis and the wider mission of the Fabric Media Collection, which is not just about collecting art but also about proving that NFTs can be a valuable “equity strategy” for creating wealth that the collector then hopes to put back into the community.

I went to art school, graduating into the 2008 financial collapse. My distaste for crony bailouts is how I first found my way to blockchain, like many back then. I bought my first Bitcoin in 2012 and sold it the very next day, not exactly a diamond hand. I began accumulating it again during the 2015–16 lull running up to the 2017–18 peak. I remember I was home for Christmas as it was peaking, and I had a nightmare that it was all coming down. I woke up in the middle of the night, and it was starting to tip over so I flushed my entire bag.

When I first heard about NFTs, everything was promissory. There was no MetaMask, no OpenSea, just a bunch of ultra-annoying arguing. But at the end of 2020 the infrastructure was there, and I began creating my own art pieces, under the name Fabric Media. Throughout the following year I minted NFTs on the Ethereum blockchain via OpenSea.

The very first NFT I bought, in March 2022, was a portrait of MF DOOM—in my opinion, the greatest rapper ever. He is finding new recognition in the NFT space because he was minting rare collectibles and exploring the value of scarcity before the boom.

At the end of 2022, I went to Art Basel Miami Beach. I had absolutely no clue what I was doing. Tezos had a booth there, they were minting generative pieces that were cool, but I was just a spectator at that point. I didn’t know anyone. By the last day, I was in my hotel room, it was starting to get late, and my brain flipped and said, “Just go back to the lounge, just go.”

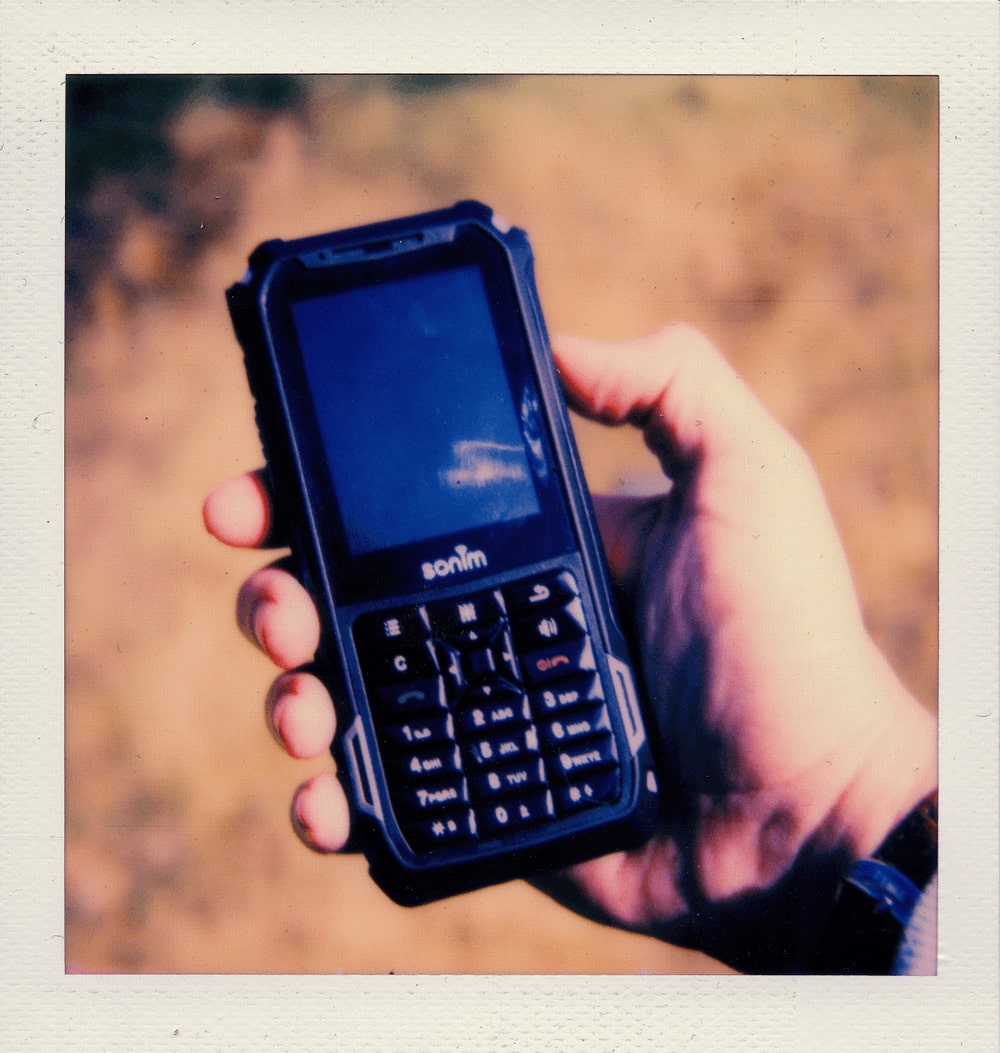

I took one lap around the booths as they were being closed. The very last one was for Arkive. I went inside and met Arkive’s Josh Phelps, who was talking to a few stragglers trying to figure out the next party. I showed him the brick phone I use in lieu of a smartphone, which I call Susan Sontag, and right then, Fabiola Larios walks in, and Phelps said, “Oh you should meet Fabiola, she does stuff with old tech too.” I showed Fabiola my phone and she insisted that I come with her and a friend to a party. We hopped in an Uber, and went to a party being thrown by Kelani Nichole and Transfer. I did not know who anyone was, but I knew that this was it, this was where I was supposed to be. I had so many incredible conversations, so many ideas were exchanged, and I learned so much.

When I eventually started thinking about collecting properly myself, I came back to Transfer. In the last dip I got some Tezos, put together a buy list, and started acquiring pieces, a lot of it from Transfer artists. I knew where I was willing to go big was the Claudia Hart piece The Dollsbox.03 (2021). Claudia had not minted much on Tezos, so I knew it was rare. Sara Ludy was holding it. I sent a couple offers, going up to 15,000 XTZ. Sara tried to call my bluff by posting it for 20,000 XTZ, and she found out I was not bluffing.

After I got that piece, Kelani reached out and told me about Transfer Data Trust. I do not want to speak on her behalf, but from a digital art collecting perspective, it is so well thought through. You make offers through an online catalog, then the Data Trust facilitates payment and prepares the work for you with contracts, certification, and an archival package. There’s also a guarantee that the artist’s proof will be maintained and updated as the technology evolves. The statement behind the Carla Gannis acquisition, which was facilitated by the Data Trust, is that not only is this a great piece but that Fabric Media is going to approach collecting by acknowledging and respecting context.

It was an opportunity to make a splash for this collection, to get folks talking. We launched a site for the collection, with the Gannis and Hart works and also a piece by Lorna Mills that I acquired through the Data Trust too. Obviously these were breakthrough acquisitions with high prices; but when one makes a play like this, the substance emerges as the chatter dies down, and everyone realizes these prices were actually quite fair. From my point of view, I absolutely stole them.

As a collector, I am looking for artists who stand their ground, have something to say, and ultimately dazzle and surprise. I am just as excited about new and emerging artists as I am about OGs. Roccano, I am totally obsessed. Retro tech is clearly a huge theme in digital art, but there is true distinction in his choices. I especially like the humor he finds in physics. It is so rare when art is legitimately funny. Nekropunk is another whose work I could not stop buying. The Paperwork (2022) series is a masterpiece in user interaction. These pieces are the digital equivalent of sifting sand through your fingers. They are created as an aid for mental health. When I found them I was stunned. I cried a bit from the connection I felt.

Another important piece to mention is A Hand Alluding to the Future (2021) by Julian Brangold. Julian is a name in the space at this point, but I discovered this piece by playing in Decentraland. I had property there, I was wandering around, and I ran into his avatar. I think he was waiting to show the piece to someone else. I walked up to him and we had a great conversation about the piece. Earlier this year, I saw it was available and I grabbed it. I think that’s how Decentraland was supposed to feel, kind of like a video game where you can meet the artist. I don’t think much of that actually wound up happening in Decentraland. It was mostly just bad brand launches, and people bumming around the casino, but I did have that one cool exchange.

Right now a lot of people are turning to gold, and younger folks are going to crypto, but here is where art prevails as an asset: just one piece might wind up being truly special. There is no special bar of gold worth more than another bar of gold, but one art piece could launch an entire portfolio to the next level. Recently Sotheby’s used a Warhol, a Rembrandt, and a Picasso to issue a $500m bond. It’s not only an equity strategy, but also a means of hoping civilization will continue. Holding art is the perfect response to economic anxiety because it is a vote for keeping the civilized world.

In terms of NFTs, the key is the willingness to say that this is a very important art wave, and if you know where to look, you could get the next Warhol at the strike price. The mission kicks in when you step back and say, “Okay you have these assets, you can collateralize a bond, but where is this loan going? How is the money being used?” My aspiration is to use these art pieces to issue bonds for municipal loans, to be used for necessary infrastructure repair in St. Louis, where the collection is based. The aim is to put real wealth, real equity back into the community so that everyone benefits.

While for now I am anonymous—it’s a fun way to maintain some mystique—I do not think I will be anonymous forever, as I intend to take my company toward corporate partnerships, consulting contracts, perhaps even a Series A.

In the end, I want to address the critique that crypto is not real wealth. Anyone being objective can see there is a lot of validity to that critique, especially if we do not use the gain to transform actual reality. It is the same problem with stocks, it is all numbers on paper. A public park is real wealth, a functioning infrastructure is real wealth, creativity shared is real wealth.

I do not have a Warhol, a Picasso, or a Rembrandt, but what I can do is model a culture shift for both the crypto world and the art world. For an economy to function, wealth has to ebb and flow. It does no good all hoarded somewhere. Crypto was supposed to be about decentralization—I simply wish to push it back in that direction.

—As told to Gabrielle Schwarz